The European Society of Radiology (ESR) is an apolitical, non-profit organisation dedicated to strengthening and unifying European radiology to improve the diagnosis, treatment and prevention of diseases while offering their members opportunities to learn, connect and thrive.

01

Who we are

The ESR is a professional organisation that represents the field of radiology in Europe serving as a platform for radiologists, medical professionals, researchers, and other stakeholders to collaborate, share knowledge, and advance the practice of radiology. Through its numerous services, events and initiatives, the ESR strives to expand and evolve the way radiology is applied, taking action to improve patient care across the world.

02

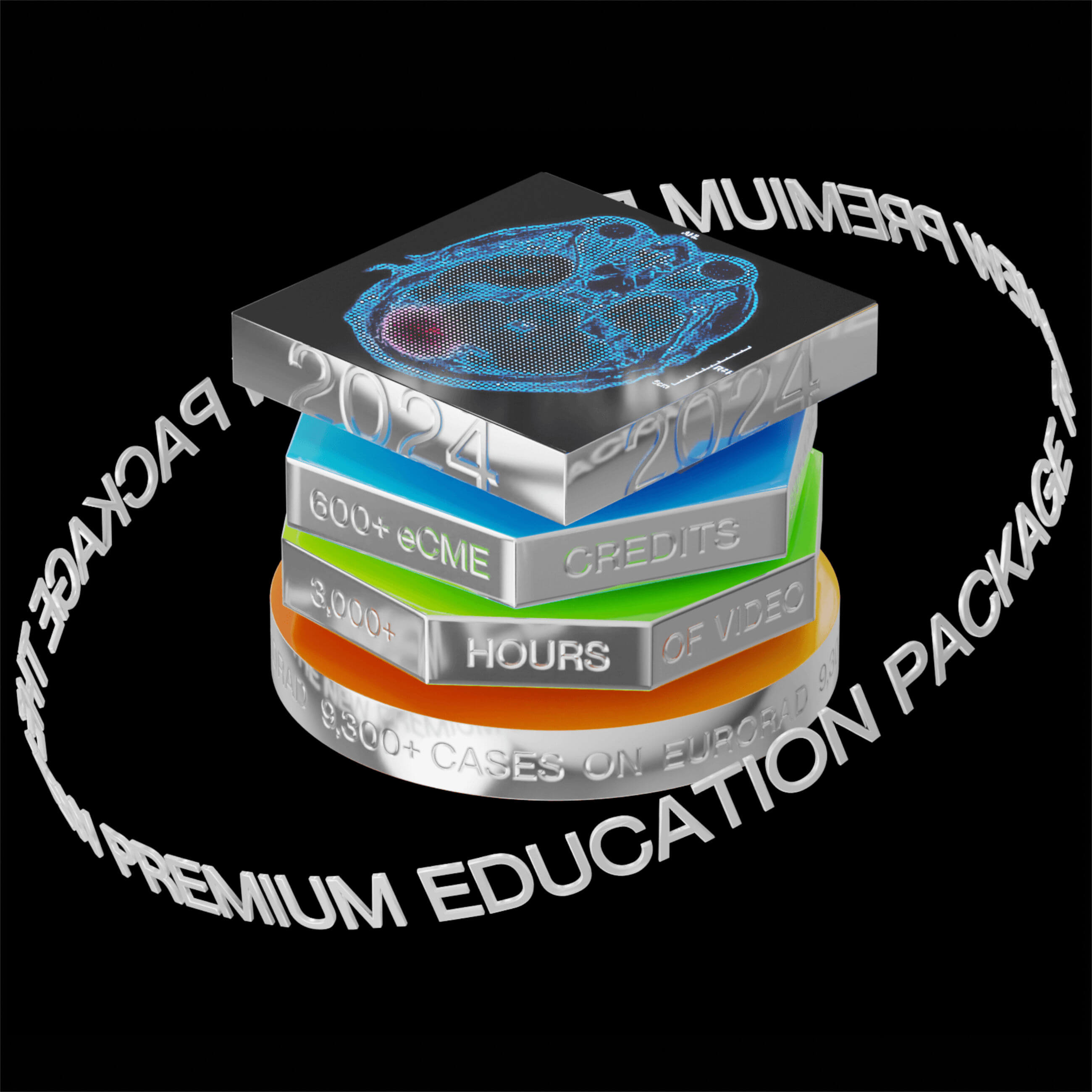

What we do

The ESR carries out ground-breaking work in education, science, research, publications and collaboration with international organisations and societies. It is also internationally renowned for the European Congress of Radiology (ECR), an annual meeting that offers visitors a glimpse into the future of medical imaging and serves not only as a connection hub for medical professionals but also for the companies that evolve radiology with their game-changing innovations.

03

How you can benefit

The ESR connects you with the world of medical imaging, keeps you up to date on scientific developments, opens the door to educational programmes and helps you to stay ahead in your profession. And the best thing about it: A full membership is less than 1 Euro/month!